cheapest auto insurance cheap car cheap car insurance auto

cheapest auto insurance cheap car cheap car insurance auto

insure money insurance cars

insure money insurance cars

Allow's clarify exactly how deductibles function as well as just how to pick the ideal one for your budget plan as well as insurance coverage demands. Simply put, a deductible is the Great site amount of money you'll have to add in the direction of working out an insurance claim.

car insurance auto insurance insurers dui

car insurance auto insurance insurers dui

You 'd have to cover half of the costs ($500) of that $1000 case. In an instance where the damages is estimated to be $500 or much less, the whole cost of repairs would certainly fall on you. Rare, there are some exemptions where an insurance deductible is non-applicable. For example, if one more guaranteed driver is accountable for your damages as well as injuries, an insurance deductible does not apply.

For new automobile owners, the outlook may not be as rosy. cheaper car insurance. The average cost of a new car is approximated to be $37,000, which leads to higher costs. If you drive a brand-new cars and truck and are associated with a major accident, it can cause thousands in damage (not to mention the possibility for injury) or amount to the automobile (car insurance).

For motorists with a high deductible, the majority of the repair work costs would certainly drop on them - car insurance. Stacking Deductible, Before finalizing on the dotted line for your policy, you should verify exactly how each scenario is dealt with.

The Main Principles Of The Instant Insurance Guide: - Delaware Department Of ...

However, your deductible is evaluated $1000, and also the contract states it is used independently - car insured. This implies you would certainly have to add towards auto fixings and also the clinical expenses of every single passenger. Therefore, always see to it your insurance deductible is bundled in as several clauses as feasible to prevent scenarios of this nature. cheap car insurance.

Not surprisingly, the possibility of being associated with an incident climbs the even more time you invest behind the wheel - car insurance. So the more you drive, the lower the insurance deductible must be to aid make certain minimal losses in case of a crash. If you're only putting in a couple of thousand miles per year, choosing a higher insurance deductible can conserve you money on your premium prices, and also this difference might be able to help contribute if a mishap does ever before happen.

While an insurance deductible might not use if you were not the driver at mistake, it doesn't necessarily protect you in instances where the responsible driver is underinsured or without insurance - cheap. The decision you make on your deductible cost ought to refer individual preference. The expense of an insurance policy costs ranges with the insurance deductible, so finding the balance comes down to analyzing your budget and also dangers of having a crash.

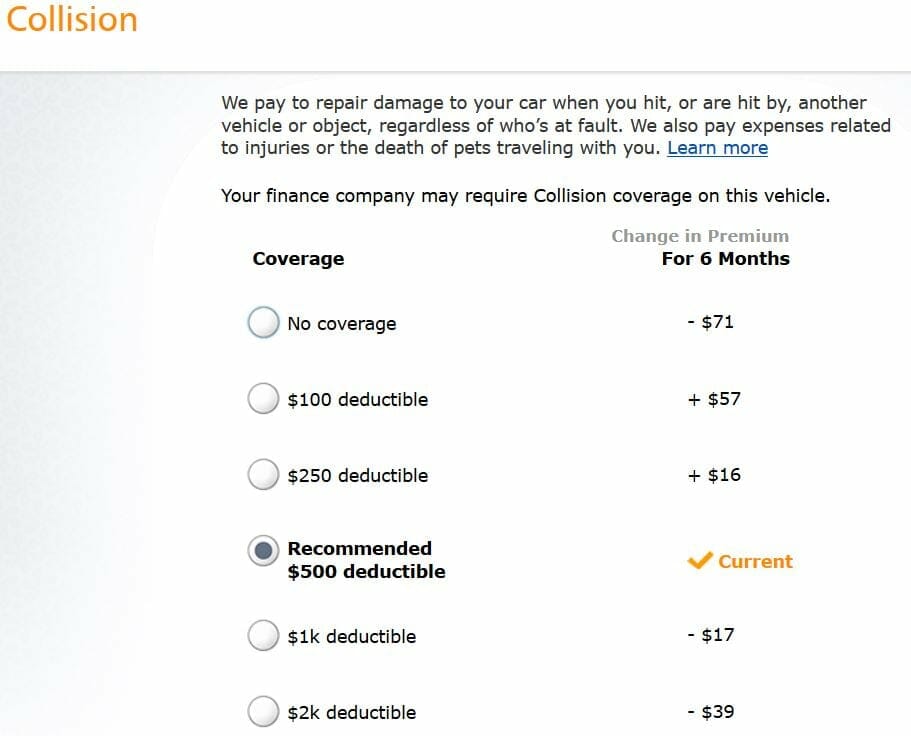

Q: Question I have to select deductibles for my automobile protection. Believe of it as a copay like you have with wellness insurance coverage. There are two kinds of vehicle insurance coverage that have deductibles: accident as well as detailed (car insurance).

The Best Guide To Car Insurance 101 - Car Insurance Faqs - The General ...

The majority of the clients I've worked with select an accident deductible of $500, however offered deductibles can range from $100 to $1,000 depending upon the insurer as well as where you live - vehicle. Deductibles additionally vary with thorough insurance coverage, which covers damage from things apart from accident, like burglary, weather, as well as wild animals - cheaper car.

Bear in mind, you pick the deductible amount that works finest for you (insurers). Since a greater deductible methods that you will certainly have to pay even more of a protected loss, a higher deductible generally suggests you'll pay much less in premium and the other way around. Your representative can sit down with you as well as crunch the numbers then you can make an enlightened choice.

When developing a spending plan for your car insurance policy, there are 2 key prices that you must keep in mind your month-to-month premiums/rates as well as your deductibles. Function of a Car Insurance Deductible, When it comes to getting vehicle insurance policy, an insurance deductible is paid when you file an insurance claim for your lorry in order to have your vehicle insurance coverage cover the repair work.

Cars and truck insurance coverage deductibles function continually via the various types of vehicle protection you might acquire for your cars and truck. There are also some insurance coverage types (like obligation) that an insurance deductible might not put on. dui. At the same time, you're also able to tailor your insurance deductible amount to better suit your car insurance coverage spending plan.

Not known Details About What Is A Car Insurance Deductible? - Promutuel Assurance

There are a number of important things you ought to understand before deciding just how much you should establish your automobile deductible amount for. credit score. We'll review what your deductibles can apply to and how they can influence your cars and truck insurance policy all at once. Take into consideration all that follows your personal guide to vehicle insurance coverage deductibles. prices.

low-cost auto insurance affordable car insurance low-cost auto insurance automobile

low-cost auto insurance affordable car insurance low-cost auto insurance automobile

Naturally, there's liability insurance policy which most states need their motorists to bring in the event they create one more chauffeur physical damage or lorry damage. Auto insurance coverage deductibles won't apply to damage that you caused to an additional vehicle driver.

These actually could be called for in some states. Injury aids cover medical expenditures for you and also various other passengers in your car at the time of the mishap. Without insurance motorist insurance coverage, as the name suggests, covers you need to you be hit by a chauffeur with no vehicle insurance coverage to cover the problems. car.